Next Big Corporate Pivot 2033: Finance and Accounting Systems Overhaul Underway; Outsourcing Sets New Industry Standard

Businesses turn to expert-led outsourcing for finance & accounting, ensuring efficiency, compliance, and scalable growth by 2033.

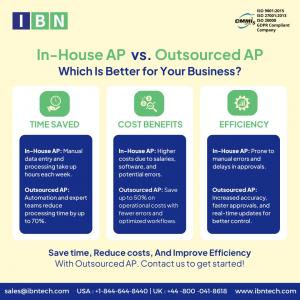

For decades, businesses have relied on internal finance teams for bookkeeping, payroll, tax compliance, and financial reporting. However, rising operational costs, workforce limitations, and the growing complexity of financial regulations have made maintaining full-scale in-house finance departments increasingly challenging. As a result, companies are integrating outsourced finance and accounting systems to enhance efficiency, reduce costs, and streamline financial operations.

Streamline Your Financial Operations with Outsourcing Today! Click To Start!

Ajay Mehta, CEO of IBN Technologies, a leading finance outsourcing firm, notes that outsourcing is now a competitive necessity rather than an alternative. “Partnering with a reliable service provider ensures businesses receive high-quality financial services tailored to their operational needs. Accuracy, compliance, and security are paramount in modern finance, and outsourcing firms like IBN facilitate these processes effectively.”

Compliance and Risk Management Drive the Shift

With evolving regulatory requirements, financial compliance is becoming more complex for businesses across industries. Many organizations outsource finance and accounting functions to specialized firms with deep expertise in compliance, tax laws, and international financial reporting standards. This approach helps businesses avoid costly errors, penalties, and regulatory risks while ensuring strict adherence to legal frameworks.

Financial security remains a top concern for companies outsourcing their finance functions. Leading outsourcing providers implement stringent security measures, including secure data handling, encrypted financial transactions, and strict regulatory compliance. With growing concerns over fraud and financial breaches, outsourcing is increasingly viewed as a risk mitigation strategy that safeguards financial operations and maintains trust.

India Emerges as the Global Hub for Finance and Accounting Systems Outsourcing

As demand for efficient outsourcing solutions grows, India has strengthened its position as a top destination for finance and accounting services. A skilled workforce, cost-effective service models, and expertise in financial regulations across multiple markets have contributed to the expansion of India’s outsourcing industry. International corporations are increasingly relying on Indian outsourcing firms for essential financial processes, including bookkeeping, financial planning, and reporting.

Beyond cost savings, companies benefit from round-the-clock service availability, multilingual support, and highly trained finance professionals who ensure accuracy and efficiency in financial operations. The trend underscores a broader industry shift towards globalized finance and accounting systems management solutions.

Hybrid Outsourcing Model Gains Popularity

While full outsourcing continues to rise, many businesses are adopting a hybrid model, retaining essential finance functions in-house while outsourcing specialized or labor-intensive tasks—such as accounts payable, payroll management, and compliance reporting. This model allows businesses to maintain strategic control while leveraging outsourced expertise to improve efficiency and cost-effectiveness.

“The hybrid model provides a flexible approach, enabling businesses to outsource financial functions without completely relinquishing internal financial control,” Mehta explains. “By striking a balance, companies can enhance operational efficiency and reduce unnecessary costs while maintaining oversight over critical financial data.”

Adopt a Hybrid Finance Outsourcing Model for Maximum Control! Get Expert!

Businesses increasingly require real-time financial data to make informed decisions in a competitive market. Outsourcing firms provide customized financial reporting and dashboards that offer executives clear insights into company revenues, expenses, and cash flow. These real-time updates enable businesses to adjust budgets, manage liquidity, and plan for growth without relying on outdated manual reporting methods.

By outsourcing finance and accounting systems operations, companies gain access to specialized expertise that enhances financial transparency and ensures accurate, timely reporting. This shift allows business leaders to focus on growth strategies rather than administrative financial tasks.

While cost savings remain a major factor, scalability is becoming equally important. Maintaining an in-house finance team requires significant investment in salaries, training, and infrastructure. Outsourcing eliminates these overhead costs while giving businesses access to highly skilled finance professionals without the financial burden of full-time employment.

Outsourced finance services also enable businesses to scale operations seamlessly. During tax season, audits, or periods of expansion, companies can adjust their outsourcing needs without the complexities of recruitment and onboarding. This flexibility ensures that businesses receive the right level of financial support as required.

As financial operations become increasingly complex, outsourcing is shifting from an option to an essential strategy. The finance and accounting outsourcing sector is expected to become the standard model for businesses of all sizes by 2033, allowing them to streamline operations and focus on core growth strategies. Organizations that embrace this transition will position themselves for greater financial stability, risk mitigation, and long-term success. With industry leaders refining outsourcing models to deliver greater value, the corporate pivot toward finance and accounting outsourcing is well underway.

Companies like IBN continue to be at the forefront of financial outsourcing, driving innovation and setting new industry standards in efficiency, regulatory compliance, and technological advancement.

Source:

Outsourced Finance and Accounting USA | IBN Technologies

https://www.ibntech.com/blog/outsourcing-finance-and-accounting-impact-business-strategy/?pr=EIN

Explore More Services:

1) USA Bookkeeping Services:

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

2) Tax Filing in the United States Guide

https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=EIN

3) AP/AR Automation Services

https://www.ibntech.com/ap-ar-automation/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release