Williamson Central Appraisal District 2024 Revaluation

O'Connor has completed an analysis for the 2024 Revaluation conducted by the Williamson Central Appraisal District.

AUSTIN , TEXAS , UNITED STATES , May 2, 2024 /EINPresswire.com/ -- Williamson Central Appraisal District has released proposed noticed values for property tax assessments for 2024. WCAD raised the value of homes by 4.1% and the value of commercial properties by 12.5%. While these increases include both existing and new construction, they are generally inconsistent with market trends reported by independent third parties.

Proposed Value Notices

The notices being sent by Williamson Central Appraisal District are referred to as “proposed” or “preliminary” because they are subject to discussion and negotiation. Property taxes are the one type of tax which is subject to negotiation if deemed excessive. When you go to a store to buy retail goods, the amount of sales tax is not subject to negotiation. After you complete your IRS forms, the amount of income taxes you pay is not subject to negotiation. However, you can negotiate your property taxes, each and every year.

Why Property Taxes are Subject to Negotiation

Williamson Central Appraisal District has limited resources to accomplish the mammoth task of valuing all real estate and taxable business personal property within Williamson County. WCAD does have a budget of $10.25 million and 38 appraisers to value the 259,000 property tax parcels. The total value of these properties is $132 billion. Because of the limited resources, the appraisal district uses a process called mass appraisal to value each property. Unlike when you obtain an appraisal to finance or refinance your home, it is highly unlikely that a representative of the appraisal district will visit your home, measure it and make an evaluation of its current condition. Because the appraisal district uses an inexact process to estimate market value for the 259,000 property tax parcels in Williamson County, the legislature has provided a process for property owners to review and challenge their property tax assessment on an annual basis. Both the appraisal district and the legislature understand that it is impossible for the appraisal district to accurately value every property in the county on an annual basis. The number of tax parcels, appraisal district budget, and the number of appraisers is based on data from 2022, which is the most current information available.

Williamson County Residential Property Tax Reassessment

WCAD estimates the value of homes has increased by between 2% and 6% depending on when they were built. However, third party companies including Zillow, Austin Board of Realtors and USA Today estimate that Williamson County home values declined 7.2%, 2.5%, and 6.2%, between January 2023 and January 2024. Conversely, Realtor.com estimates the median home price in Williamson County rose 2.2% during the same period.

Hence, it appears that WCAD may have over-shot market value since three of four independent sources indicate Williamson County home values fell between January 2023 and January 2024 while WCAD reports values increased about 4%.

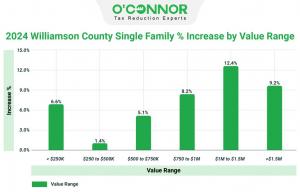

Property Tax Revaluation by Value Range

The analysis of property tax assessment by value range differs for Williamson County compared to the analysis completed for other counties analyzed so far, including Fort Bend County, Travis County and Harris County. In those counties, there is a clear correlation between value range and assessment increases. Homes with the lowest values have the lowest amount of increase, while homes in the highest value strata have the highest increases. The amount of increase in assessed value rises as home values rise. However, the pattern is different in Williamson County.

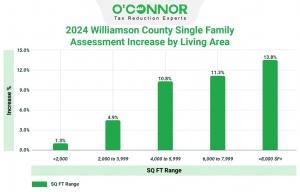

Tax Revaluation versus Home Size

There is a clear positive correlation in the amount of property tax assessment increase when considering the size of a home in Williamson County, for the 2024 property tax reassessment. Homes with less than 2,000 square feet registered a modest 1.3% increase in taxable value. However, homes with over 8,000 square feet incurred increases in their market value assessment of 13.8%, versus an overall increase of 4.1%.

Williamson County Commercial Property Revaluation

Williamson Central Appraisal District increased the market value of all types of commercial property for tax year 2024 including apartments, office, retail, warehouse, hotel, and land. The overall rate of increase by WCAD was 12.5%.

Warehouse and retail properties suffered the largest increases in property tax assessment increases at 35.2% and 29.7% respectively. Land and apartments had the smallest level of increase at 1.6% and 8.4% respectively.

Williamson Central Appraisal District is inconsistent with the trends for commercial properties reported by Green Street, a recognized Wall Street advisory firm. Green Street reports that commercial values have fallen 7% in the last year and 21% since the peak in 2022. In addition, analysis of the Green Street Commercial Property Price Index indicates that commercial property values have fallen back to levels last seen in late 2014.

Why has the Value of Commercial Property Declined?

There are a handful of reasons why commercial property values have declined, but the most significant is the substantial increase in interest rates following the easy money during COVID.

Create Branded Table with Data Below:-

Date 10-Year-Treasury Rate

January 2020 1.92%

January 2021 0.96

January 2022 1.71

January 2023 3.79

January 2024 4.05%

COVID hit the United States in force in March of 2020. By January 2021, interest rates have fallen by half thus providing inexpensive money and artificially increasing commercial real estate values. As seen in the analysis provided by enriched real estate, the volume of mortgages and sales of commercial property soared in 2021 and 2022 but then fell back sharply in 2023.

Other Factors Impacting Commercial Real Estate Values

In addition to higher interest rates, other factors negatively affecting the market value of commercial real estate include higher operating expenses, particularly for casualty insurance and property taxes. Loan underwriting standards have gotten much tougher and the amount of loan proceeds available has shrunk materially. Finally, there are property specific issues such as the concern over the long-term outlook for office buildings. In the short term overbuilding of apartments in many areas including the Austin metro area is negatively impacting value.

Transaction Volume Falls by Half between 2022 and 2023

The volume of annual commercial real estate transactions was approximately $2 trillion in 2021 and 2022 but fell back by half to $ trillion in 2023.

Commercial property of all vintages incurred substantial increases in taxable value in 2024 as estimated by Williamson Central Appraisal District. Property built between 1981 and 2000 Had the highest level of increase at 17.5%, followed by property built between 2001 and later at 15.7%. Property built before 1960 had the lowest level of increase at 6.9%, other than land which increased only 1.8%.

We see a strong positive correlation between value strata and the amount of property tax assessment increase described by Williamson CAD in 2024. Property valued at less than $500,000 had a 1.2% reduction in assessed value while properties valued over 5 million had a 15.2% increase in assessed value for 2024. This trend of lower value properties having lower levels of increase and properties valued over $5,000,000 having higher levels of increase has also existed in Harris County, Fort Bend County and Travis County.

There is little discernible relationship between year built and level of property tax assessment increase for apartments in Williamson County in 2024. Apartments built prior to 1960 did decline by 20.7%. However, the total value of apartments built prior to 1960 was only $2.5 MM out of a total of $13.6 billion. Conversely properties built in 2001 and later increased by 10.9%. Apartments labeled “other” do not have a year built provided by WCAD.

Office buildings increased substantially in value regardless of age, as estimated by Williamson Central Appraisal District for tax year 2024. This is puzzling given that the overall office building vacancy rate for the Austin metro area, including direct vacant space and sub lease space, is about 35%. Further, both equity investors and lenders have generally been avoiding office buildings during the last several years as uncertainty over their long term viability continues to be uncertain.

Almost daily and certainly weekly there is another article about an institutional owner of an office building defaulting because they can not refinance the loan.

Williamson County retail property owners are suffering from large increases in property tax assessments for tax year 2024. Properties built prior 1960 and those without a year built reported by Williamson Central Appraisal District had the lowest levels of increase at 6.6% and 2.8%, respectively. However, properties built between 1961 and 1980 increase 18.4% while properties built between 1981 and 2000 increased a colossal 49.4%. The taxable value of retail properties in Williamson County built in 2001 and later were increased almost by 24.1%.

Williamson County warehouse buildings of various vintages all received whopping increases ranging from 14% to 40%. Warehouse buildings in Williamson County built prior to 1960 and in 2001 and later received staggering increases of 33.2% and 39.9% respectively. However, there is a de minimis amount of Williamson County warehouse buildings built prior to 1960 (only $3.1 million). Warehouse buildings built between 1961 and 2000 drew increases of 14 to 15%.

Williamson office building owners were likely hoping for property tax relief in 2024. Instead, Williamson central appraisal district increased the taxable value of office buildings by almost 20%. Considering the staggering 35% vacancy rate in the Austin metro area, including both direct vacancy and sub lease vacancy, it is difficult to understand the basis for these large increases. Low-rise office buildings increased by 17.6% and high-rise office buildings increased by 21.3%. Medical office building values were boosted a bit less at 13.1% in 2024.

Williamson county retail suffered an average increase in taxable value of 30% in 2024. The most surprising news from the Williamson County property tax assessment for 2024 is a 51% increase for malls, which have generally been struggling for over a decade. Williamson Central Appraisal District lifted the taxable value of strip centers by 20.2%, neighborhood shopping centers by 33.4%, community shopping centers by 32.4% and single-tenant retail buildings by 14.4% All of these hikes are inconsistent with the analysis by Green Street and by the substantial increases in interest rates which have led to higher capitalization rates and lower commercial real estate values.

Williamson County warehouses drew the highest increase in property tax assessments for 2024. Mini warehouses, also known as self-storage, increase by 10.5%. Office warehouse properties skyrocketed by an incredible 53.9%. Warehouse buildings, without further description, account for only a small fraction of Williamson County warehouses and rose by 6.6%.

Summary and Conclusions

The residential property tax assessment increases in Williamson County for tax year 2024 are likely to be hotly contested since they are directionally different from the analysis provided by third-party data providers. Most analysts of the Williamson County single-family home market indicate there was a modest decline in value during 2023. Despite the consensus opinion of a slight drop in home values, Williamson Central Appraisal District has applied 4% increase to home values for Williamson County.

Commercial property owners can be expected to protest in mass given the large levels of increase which are inconsistent with market trends for commercial real estate. Independent Wall Street firm Green Street reports a decline in commercial property values of 7% in 2023 and 21% since the peak in 2022. This is consistent with the increase in interest rates which tripled since the low point in January 2021.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.